Customer Lifetime Value (CLTV / CLV / LTV)

In this chapter we will discuss the Value of Customer Lifetime. Have you heard someone talk about this KPI before? – Chances are you have. Remember when we talked about Salesforce and how their true potential was only released after they fixed their leaking bucket?

Customer Lifetime Value

In the leaking bucket example, water was the valuable good that we wanted to save from churning away at all costs. The less water we lose and the longer we can keep the customer acquisition tap going – the more water we collect over time.

In our example, water stood for money, and the same applies to your company: The longer a subscriber to your service remains your customer, the higher his lifetime value.

This is exactly what this KPI is about. Customer Lifetime Value or short CLTV is the average amount of money that a customer makes you over their entire lifespan.

Do you like Starbucks? How much does an average cup of coffee cost? Covered with 2 espresso shots, 2 pumps of hazelnut syrup and whipped cream – probably around 5 dollars.

And how many coffees does the average customer buy? If I take my colleagues as a basis, I would say at least 200 over the customer’s lifetime span. So in this example, the Starbucks Customer Lifetime Value would be $5 times 200 visits, so $1,000.

By the way, Customer Lifetime Value (CLTV), Lifetime Customer Value (LCV), or Life-Time Value (LTV) – it’s all the same! But in the following I will use CLTV as short form.

CLTV = CLV = LTV

All the same!

Calculating your CLTV

Way 1:

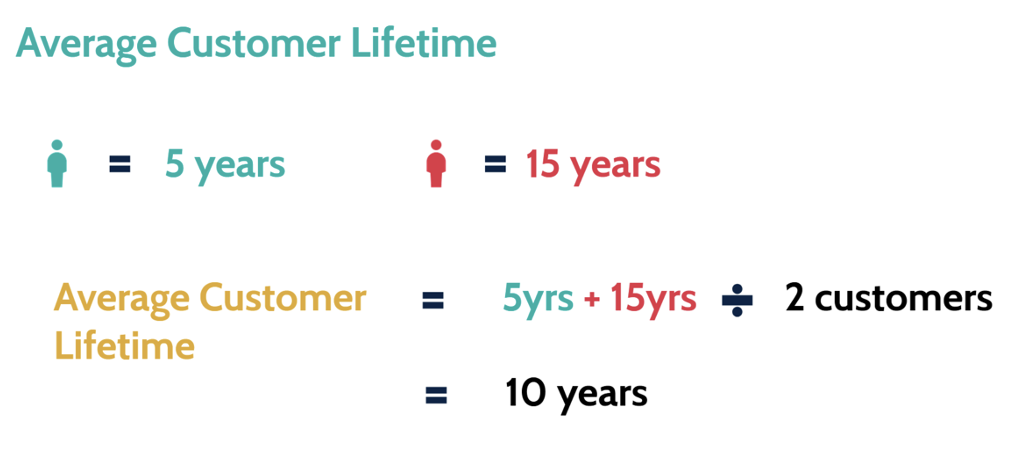

How is the CLTV calculated? Well, the first thing we need to find out is how long someone stays a customer on average. Think of Spotify as an example: If one customer stays a customer for 5 years and another customer stays a customer for 15 years, then the average lifetime of both customers is 10 years.

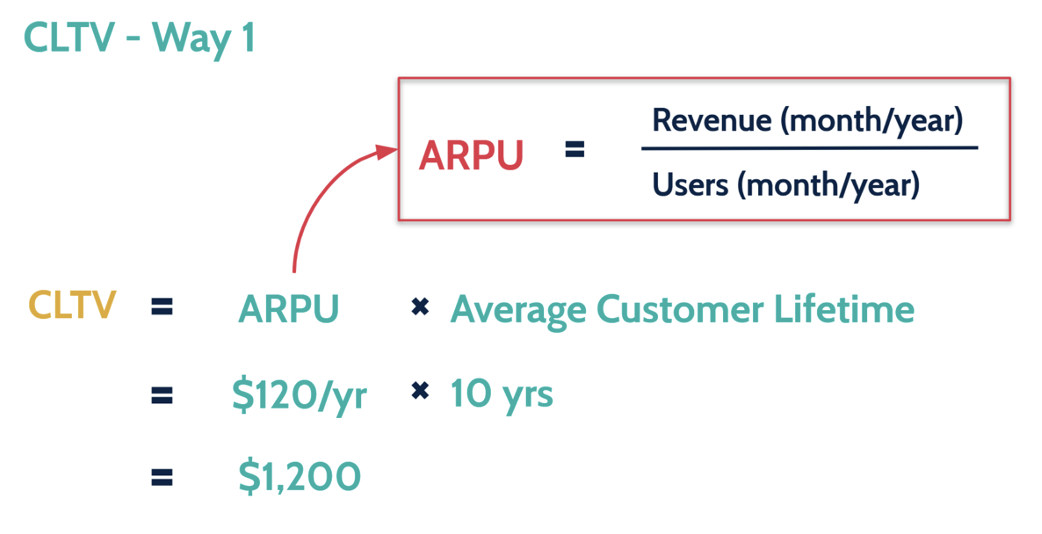

Next thing we need is our Average Revenue per User. Remember the KPI ARPU we talked about in the earlier chapters? It was simply your total revenue divided by your total users. With an average of $120 per year from our Spotify customers and an average length of stay of 10 years, our CLTV is $1,200.

But what if I don’t know my average lifespan? Do I really have to wait 15 years until my last customer has left me to calculate the CLTV? Fortunately not! If you do not know your average lifetime, you can use way number 2.

Way 2:

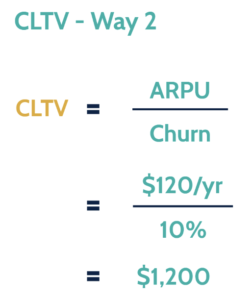

Way number 2 makes use of the inverted churn rate. Remember when we talked about churn and the nice by-product of churn is that you can calculate the average time someone remains a customer?

All you have to do is divide 1 by the churn rate. So for our Spotify example, let’s assume we have 1 million customers churning each year and a total of 10 million customers. Dividing 1 by 10 gives an annual churn rate of 10%.

If we calculate the inverted churn rate now, by dividing 1 by 10% churn rate – we land at 10 years average lifetime. We can take advantage of the same trick for our Customer Lifetime Value. The formula is CLTV equals ARPU divided by churn rate.

If Spotify has a 10% annual churn rate, then the average revenue of $120 per user divided by 10% is $1,200 as a lifetime value for our customer.

So on average we all pay $1,200 to Spotify? Well, I don’t know the exact figure, but I imagine it somewhere in that range. That sounds like a lot, but do you remember how much you spend on your CD collection?

I bet that some of you reading this never bought a single CD, but let me tell you that listening to music was an expensive hobby back then.

CLTV Graph

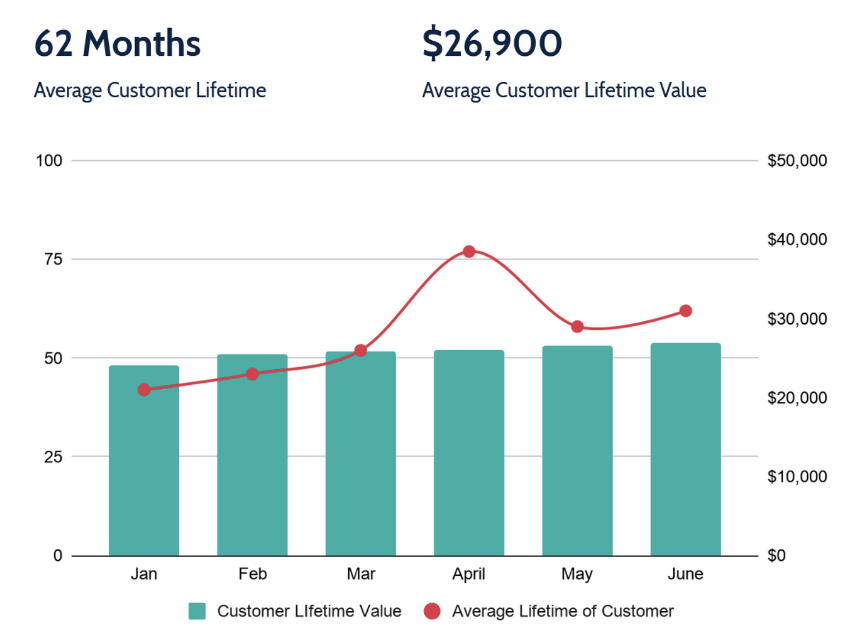

The following graph can be used to report on your CLTV.

In the graph we see the customer lifetime in turquoise and in red the actual dollar amount for lifetime, both on a monthly basis. We can see that both figures are relatively stable and on an upward trend. This company snailed it!

Summary

CLTV is the customer value over its entire lifetime and the longer the customer stays, the higher is the CLTV

When talking about CLTV, CLV or LTV – we mean the same

If we don’t know our average lifetime, we can use of the Inverted Churn rate

And the real kicker of this KPI is that it shows us how much we can spend on acquiring new customers. In other words, how much can marketing and sales spend so that we still make money.

This is actually such a big deal, that it needed an entire, separate chapter about this.

I will see you in the next chapter, where I will talk about the relationship between Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV). See you there!